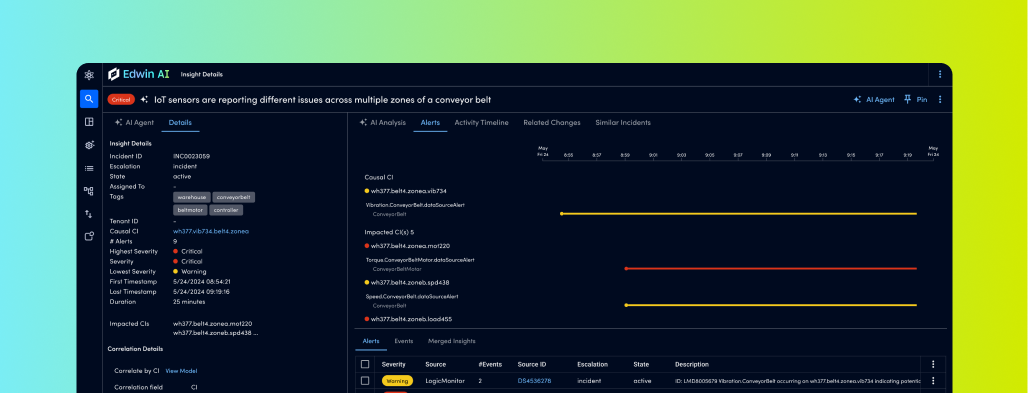

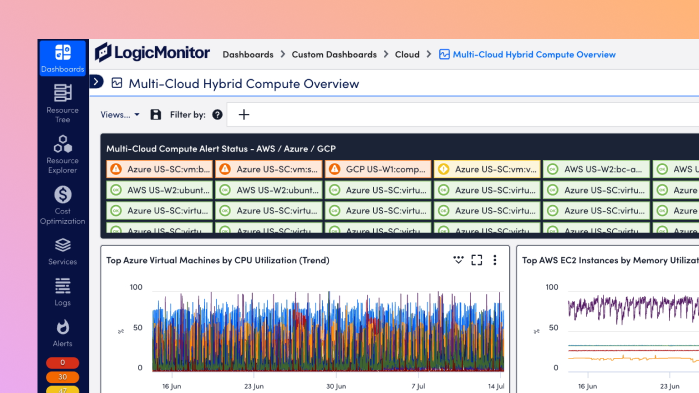

Hybrid Observability for Financial IT Teams

Financial Services IT Monitoring: Unified, Intelligent, Compliant

Maintain uptime across banking, trading, and claims systems while staying ahead of audits, minimizing downtime, and delivering frictionless digital experiences.